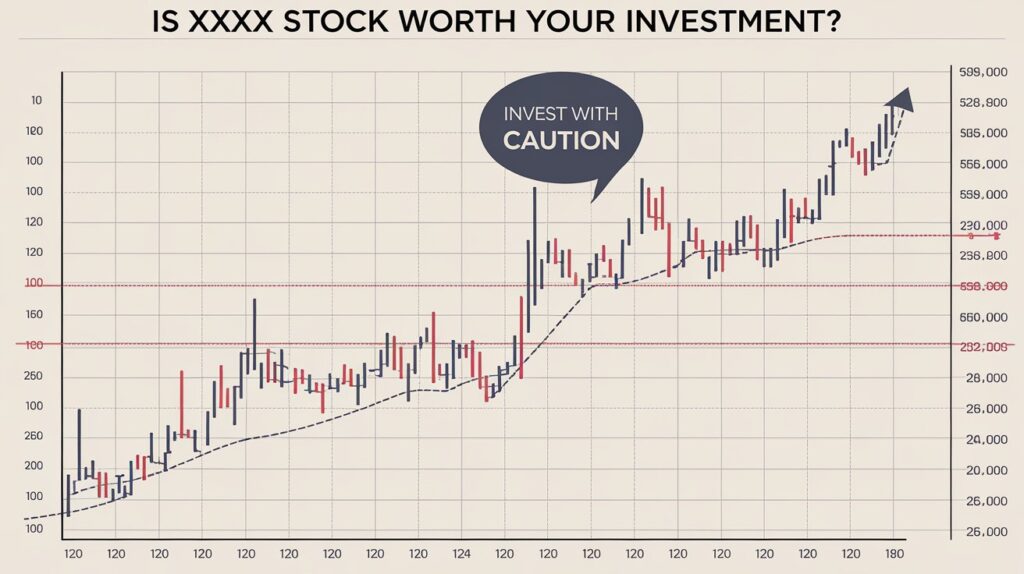

Is XXXX Stock Worth Your Investment?

November 22, 2024Investing in the stock market can feel like navigating a maze of opportunities and risks. Among these options, XXXX stock has garnered attention for its performance and potential. But is it truly a wise addition to your portfolio? This article explores everything you need to know about XXXX stock, from its recent trends to its long-term prospects.

What Makes XXXX Stock Unique?

XXXX stock has captured the market’s interest due to its distinct positioning in [industry/sector]. The company’s innovative approach to [specific aspect of the business, e.g., sustainability, technology, or product offerings] sets it apart from competitors. It has consistently demonstrated a commitment to [specific strength, e.g., customer satisfaction, environmental initiatives, or market leadership], making it a standout player in its field.

Moreover, XXXX stock’s financial performance reflects a solid foundation. Recent earnings reports highlight consistent revenue growth, signaling the company’s capability to navigate market fluctuations. This steady trajectory reassures investors looking for stability in uncertain economic climates.

Key Factors Driving XXXX Stock’s Performance

Several factors contribute to XXXX stock’s appeal:

- Market Trends: The company operates in a thriving sector that aligns with global trends, such as [example: renewable energy, digital transformation, or health tech]. This alignment positions it for continued growth.

- Innovative Strategies: XXXX stock benefits from the company’s forward-thinking strategies, including investments in [specific innovation or technology].

- Strong Leadership: Effective management plays a crucial role in steering the company toward sustained success. Leadership’s focus on [strategic priority] ensures the company remains competitive.

These strengths give XXXX stock a competitive edge, making it an attractive option for investors seeking long-term gains.

Should You Invest in XXXX Stock Now?

The decision to invest in XXXX stock depends on several considerations. First, assess the company’s valuation. While XXXX stock has shown robust growth, overvaluation could limit short-term returns. Evaluate its price-to-earnings ratio and compare it with industry benchmarks to gauge whether the stock is fairly priced.

Second, consider your risk tolerance. While XXXX stock offers a promising outlook, no investment is without risk. Fluctuations in the broader market or unexpected challenges within the company’s sector could impact its performance. Diversifying your portfolio can help mitigate such risks.

Risks to Keep in Mind

Despite its strengths, XXXX stock is not immune to challenges. Key risks include:

- Market Volatility: Sudden economic shifts or global events could affect its stock price.

- Competitive Pressure: Rapid innovation in the sector might lead to increased competition.

- Regulatory Hurdles: Changes in government policies could impact operations or profitability.

Being aware of these risks helps investors make informed decisions and set realistic expectations.

XXXX Stock in the Long Run

For investors with a long-term perspective, XXXX stock holds significant potential. The company’s commitment to [specific strategy or market niche] positions it for sustained growth. Furthermore, its focus on [sustainability/innovation/customer engagement] resonates with changing consumer and investor preferences.

Long-term investors should monitor the company’s performance against key benchmarks, such as revenue growth, market share, and innovation milestones. Consistent updates on these metrics provide insight into whether XXXX stock continues to align with your investment goals.

Also Read: Walgreens SoldPBM: What It Means for Healthcare

Final Verdict

XXXX stock presents a compelling case for investors seeking growth opportunities in a dynamic market. Its solid financials, innovative strategies, and alignment with global trends make it a strong contender for long-term portfolios. However, as with any investment, due diligence is crucial. Evaluate your financial goals, risk tolerance, and the broader market landscape before making a decision.

Whether you’re a seasoned investor or just starting, XXXX stock offers an intriguing opportunity worth exploring. Remember, informed investing is key to building a resilient and successful portfolio.

[…] Also Read: Is XXXX Stock Worth Your Investment? […]